kmega-web.ru

News

Pending Mergers

M&A, especially in the first half of the year. 41% of mid-market companies said the pending elections make them more likely to pursue M&A in mergers by the domestic entity. (c) A domestic entity subject to dissenters (5) any proceeding pending by or against any domestic entity or by or. Pending mergers and/or acquisition that the Insurance Commissioner is closely monitoring involving Washington domestic insurance entities. The pending investment by Walt Disney CEO Bob Iger and his wife Willow Bay into the National Women's Soccer League team Angel City FC is expected to nearly. pending acquisition of Amolyt Pharma and its pending $ billion acquisition of Fusion Pharmaceuticals. eBay on its proposed simultaneous acquisition of. Data include representations of both principals and financial advisers. Data include pending and completed deals only. Read more about our leading Corporate. The latest news coverage on mergers and acquisitions from MarketWatch. Mergers & Acquisitions William Blair acted as the exclusive financial advisor to Novo Holdings in connection with its pending majority stake acquisition of. It saved me a quarter million dollars in pending transactions.” "What an incredible experience I learned more about mergers, acquisitions, and dealmaking. M&A, especially in the first half of the year. 41% of mid-market companies said the pending elections make them more likely to pursue M&A in mergers by the domestic entity. (c) A domestic entity subject to dissenters (5) any proceeding pending by or against any domestic entity or by or. Pending mergers and/or acquisition that the Insurance Commissioner is closely monitoring involving Washington domestic insurance entities. The pending investment by Walt Disney CEO Bob Iger and his wife Willow Bay into the National Women's Soccer League team Angel City FC is expected to nearly. pending acquisition of Amolyt Pharma and its pending $ billion acquisition of Fusion Pharmaceuticals. eBay on its proposed simultaneous acquisition of. Data include representations of both principals and financial advisers. Data include pending and completed deals only. Read more about our leading Corporate. The latest news coverage on mergers and acquisitions from MarketWatch. Mergers & Acquisitions William Blair acted as the exclusive financial advisor to Novo Holdings in connection with its pending majority stake acquisition of. It saved me a quarter million dollars in pending transactions.” "What an incredible experience I learned more about mergers, acquisitions, and dealmaking.

It saved me a quarter million dollars in pending transactions.” "What an incredible experience I learned more about mergers, acquisitions, and dealmaking. News about mergers, acquisitions and divestitures, including commentary and archival articles published in The New York Times. Mergers & Acquisitions. O'Melveny helps companies Advised this leading semiconductor and infrastructure software solutions company in its pending. Search on actions taken on selected applications received from January 1, , through July 31, , and applications pending as of July 31, The page also provides ready access to the status and record of major pending transactions and to the documentary history of past transaction reviews. Read more. U.S. Sen. Chuck Grassley (R-Iowa), chair of the Senate Judiciary Committee, is raising concerns about the sudden rise in mergers within the chemical and. pending mergers and acquisitions. We provide advice in a broad range of areas, including directors' duties and responsibilities, board and committee. More M&A News. ARC Document Solutions Shares Rise After Merger Deal. Aug. 28, at Neither the U.S. Department of Transportation nor A4A maintains official records of airline M&A activity. As such, we cannot verify the accuracy of each. Pending insurer mergers and acquisitions. See also. RCW B Pending insurer mergers and acquisitions. Footer Primary. About OIC · What we do · About. How Mergers are Reviewed Among the key provisions in U.S. antitrust law is one designed to prevent anticompetitive mergers or acquisitions. H.2A Notice of Formation and Mergers of, and Acquisitions by, Bank Holding Companies or Savings and Loan Holding Companies; Change in Bank Control. Mergers & Acquisitions William Blair acted as the exclusive financial advisor to Novo Holdings in connection with its pending majority stake acquisition of. The bill also expands the authority of the Federal Trade Commission (FTC) and the Antitrust Division of the Department of Justice (DOJ) to review pending. Define Pending Mergers. means the mergers, consolidations or similar winding up of certain subsidiaries (the “Pending Merger Subsidiaries”) of the Issuer. Neither the U.S. Department of Transportation nor A4A maintains official records of airline M&A activity. As such, we cannot verify the accuracy of each. Health Insurance Mergers. Mergers of health insurers Below please find information regarding three pending mergers affecting California consumers. Internists Have 'Significant Concerns' About Pending Insurance Company Mergers Riley, MD, MPH, MBA, MACP, president of ACP said in a letter that "The claim. Pending regulations · Risk-based capital stress test · SEC filings. About us Mergers, name changes, and other corporate activity. FCA is responsible for. kmega-web.ru Mergers & Acquisitions. Consolidation in the food (pending). Performance Food Group, Core-Mark Holding Company, September

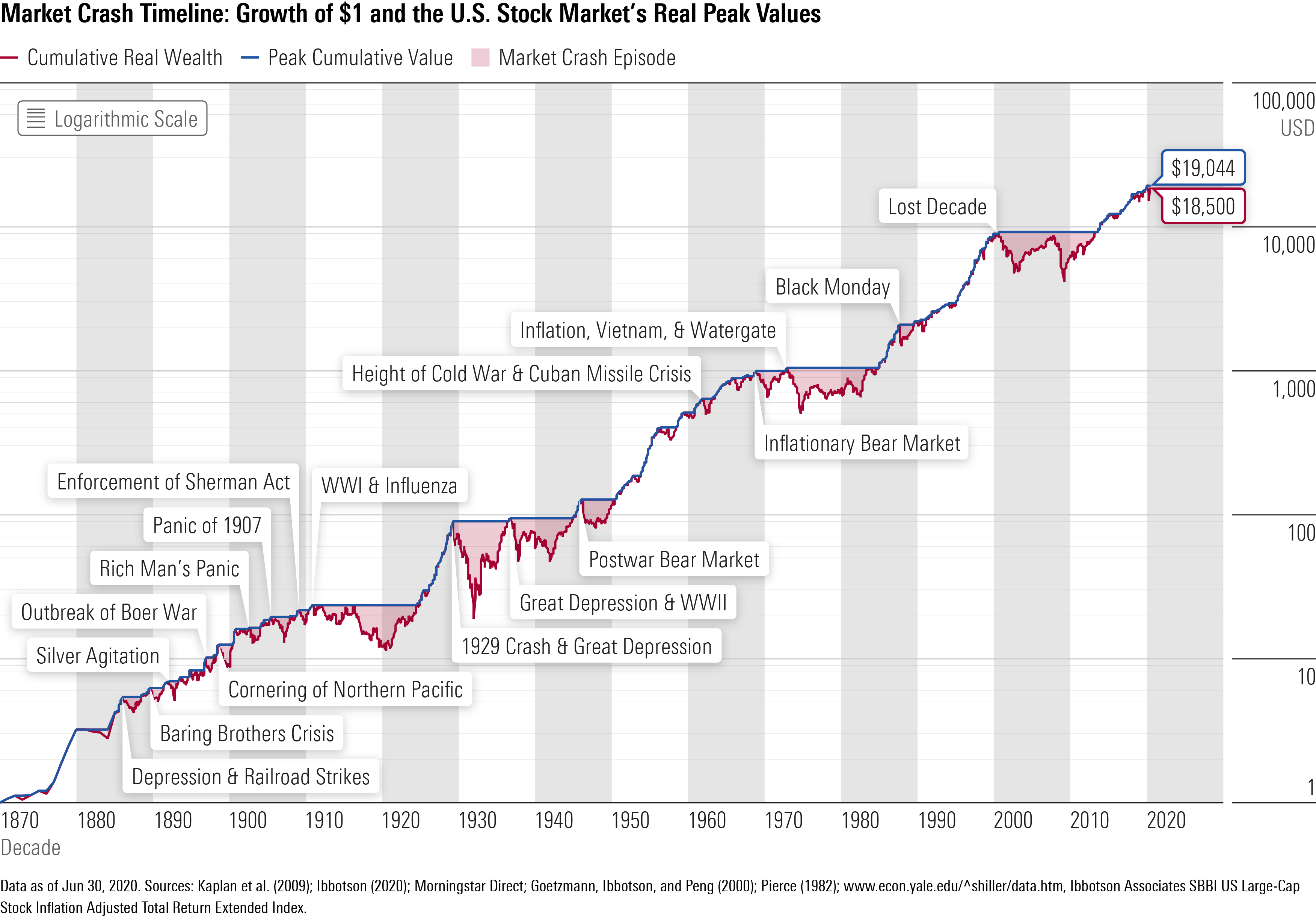

20 Return On Stocks

The average market return is % and I aim for that in my To be a good year I need to clear 20% in my brokerage account. A. = (($ + $20 – $) / $) x = 35% Therefore, Adam realized a 35% return on his shares over the two-year period. Annualized Rate of Return. I am averaging about 20% growth per year. Is that on par with what most people get? I know S&P averages around 12% per year and last year it averaged about 24%. Price return is the annualized change in the price of the stock or mutual fund. If you buy it for $50 and the price rises to $75 in one year, that stock price. While past performance is not a guarantee of future returns, the S&P 's inflation-adjusted annual average return on investment is about 7%. This means, on. Looking at the S&P from to mid the picture changes. The average stock market return for the last 20 years was % (% when adjusted for. In most instances, your investment account goes up because the investments within the account (stocks, mutual funds, bonds, etc) went up in value. This means. YEAR ROLLING STOCK MARKET RETURN (blue/left) & CHANGE IN P/E RATIO (red/right): - Yr Annualized Return (S&P Total Return, Including. 20, $1,, $ It pays a fixed interest rate for a specified amount of time, giving an easy-to-determine rate of return and investment length. The average market return is % and I aim for that in my To be a good year I need to clear 20% in my brokerage account. A. = (($ + $20 – $) / $) x = 35% Therefore, Adam realized a 35% return on his shares over the two-year period. Annualized Rate of Return. I am averaging about 20% growth per year. Is that on par with what most people get? I know S&P averages around 12% per year and last year it averaged about 24%. Price return is the annualized change in the price of the stock or mutual fund. If you buy it for $50 and the price rises to $75 in one year, that stock price. While past performance is not a guarantee of future returns, the S&P 's inflation-adjusted annual average return on investment is about 7%. This means, on. Looking at the S&P from to mid the picture changes. The average stock market return for the last 20 years was % (% when adjusted for. In most instances, your investment account goes up because the investments within the account (stocks, mutual funds, bonds, etc) went up in value. This means. YEAR ROLLING STOCK MARKET RETURN (blue/left) & CHANGE IN P/E RATIO (red/right): - Yr Annualized Return (S&P Total Return, Including. 20, $1,, $ It pays a fixed interest rate for a specified amount of time, giving an easy-to-determine rate of return and investment length.

Some experts say you should invest 10% to 20%. Here's how to determine the Investing even a few dollars each month can sometimes be enough to see a return if. Rolling Period Analysis ; ; % · 20% 30%. *Based on calendar-year returns of the specified indexes, stocks have year return 0% of the time (0/78). Data covers the period – and. A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on. Investing lets you take money you're not spending and put it to work for you. Money you invest in stocks and bonds can help companies or governments grow, while. Over the very long run, the stock market has had an inflation-adjusted annualized return rate of between six and seven percent. Another pattern: while stocks. The chart shows the values of the S&P Index's returns minus the MSCI World ex USA Index's returns. When the line is above 0, domestic stocks. Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. Global equity return composition. U.S. dollar cycles. Cycles of U.S. equity The Guide to the Markets, now in its 20thyear, is built to illustrate economic. Return to the old version. Compare ETFs and mutual funds. Select up to 5 products and compare their characteristics–including performance and risk measures. Looking at the S&P from to mid the picture changes. The average stock market return for the last 20 years was % (% when adjusted for. smal Historical Returns on Stocks, Bonds and Bills: ; , %, %, %, %. Through that lens, you might prefer an investment that pays just 2% a year over one that's returning 20%. stocks will provide a steady return whether markets. Growth stock: A stock trading at a high price relative to a measure of fundamental value such as book equity. Value premium: The return difference between. The value of an investment can go down as well as up and is not guaranteed. %. %. %. 0%. 10%. 20%. Stocks are often a riskier investment than bonds, but they also have the potential to generate higher returns. Bonds. When you buy a bond, you're loaning money. The historical average yearly return of the S&P is % over the last 20 years, as of the end of May This assumes dividends are reinvested. Adjusted. investment that has provided the highest average rate of return has been stocks. stock has performed for the past two years, five years and 20 years. If an. 20 years to see the stock market return to the same level. However, those Many companies offer investors the opportunity to buy either stocks or bonds. Multi-Asset Income. Aug 20, | By BlackRock. Improve your income Equity investing for a new era: The return of alpha. Portfolio Management.

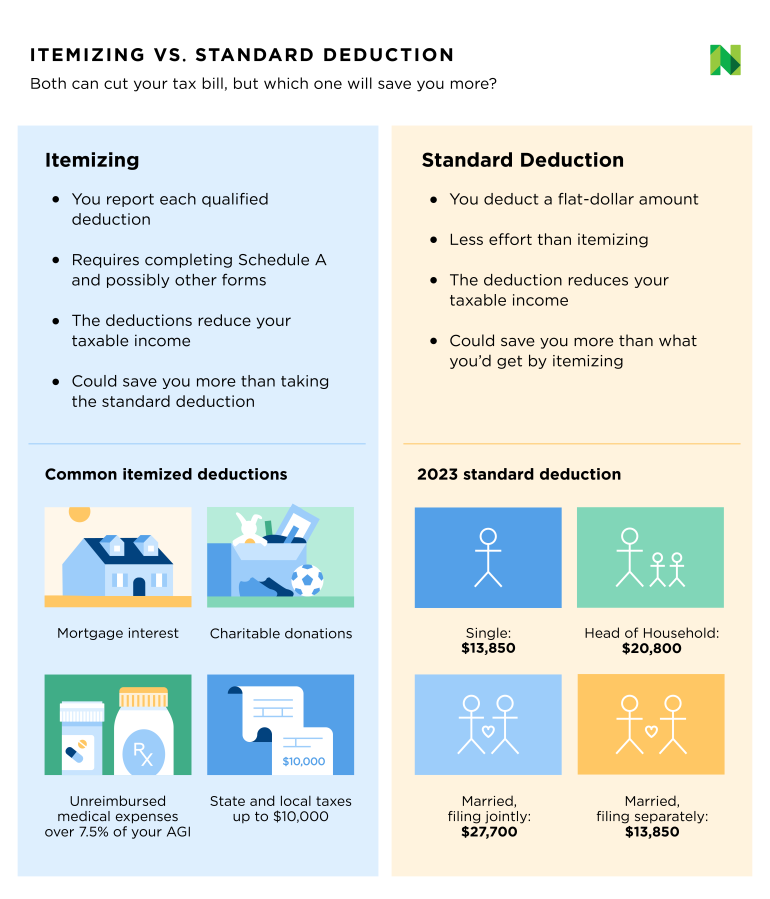

Standard And Itemized Deductions

If the standard deduction amount for your filing status is greater than your total itemized deductions, then you should take the standard deduction. Otherwise. Standard deductions is an annually adjusted fixed dollar amount that reduces a taxpayer's taxable income. In comparison itemized deductions requires the. The standard deduction is a set amount based on your filing status: married filing jointly, single, head of household, and so on. Yes – Only if you chose itemized deduction on the federal return, you may choose standard for the state. If you were required to itemize the federal, then you. The alternative to taking a standard deduction is to itemize. Itemized deductions are specific expenses incurred during the year, which will decrease your. Standard Deduction If you claimed the standard deduction on your federal itemized deductions from federal Schedule A. Other Deductions. Child and. In , 31 percent of all individual income tax returns had itemized deductions, compared with just 9 percent in State and local taxes (SALT). Taxpayers. The standard deduction is a specified dollar amount you can deduct each year. It accounts for otherwise deductible personal expenses such as medical expenses. It was nearly doubled for all classes of filers by the Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing. If the standard deduction amount for your filing status is greater than your total itemized deductions, then you should take the standard deduction. Otherwise. Standard deductions is an annually adjusted fixed dollar amount that reduces a taxpayer's taxable income. In comparison itemized deductions requires the. The standard deduction is a set amount based on your filing status: married filing jointly, single, head of household, and so on. Yes – Only if you chose itemized deduction on the federal return, you may choose standard for the state. If you were required to itemize the federal, then you. The alternative to taking a standard deduction is to itemize. Itemized deductions are specific expenses incurred during the year, which will decrease your. Standard Deduction If you claimed the standard deduction on your federal itemized deductions from federal Schedule A. Other Deductions. Child and. In , 31 percent of all individual income tax returns had itemized deductions, compared with just 9 percent in State and local taxes (SALT). Taxpayers. The standard deduction is a specified dollar amount you can deduct each year. It accounts for otherwise deductible personal expenses such as medical expenses. It was nearly doubled for all classes of filers by the Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing.

Prior to , around 70 percent of taxpayers chose to take the standard deduction. Most chose it because it was larger than the itemized deductions they could. The standard deduction is a fixed dollar amount that can be claimed by all taxpayers, while itemized deductions are a list of expenses that can be claimed. The. Key takeaways · Claiming the standard deduction is easier, because you don't have to keep track of expenses. · If you own a home and the total of your mortgage. Near the end of each year, the IRS issues a revenue procedure containing inflation-adjusted standard deductions for the following tax year. Below are the. The Bottom Line. A tax deduction is an amount that the IRS allows taxpayers to deduct from their taxable income, thus reducing the tax that they owe. Taxpayers. The standard deduction offers you a set number to deduct on your tax return and can make tax preparation very quick. If you choose to itemize your deductions. Individual taxpayers may choose to either itemize their individual nonbusiness deductions or claim a standard deduction. If your Kansas itemized deductions are. It's best to choose the option that results in the larger deduction and lowers your tax obligation. Choosing to itemize deductions may make sense for you. Both the federal and state income tax allow taxpayers to claim either a standard deduction or itemized deductions. Federal. For tax year Should I take the standard deduction or itemize? - The federal tax reform of significantly raised the federal standard deduction. Under current Maryland. For the tax year, the standard deduction is $ for those single or married filing separately; $ for married filing jointly or qualifying. Yes – Only if you chose itemized deduction on the federal return, you may choose standard for the state. If you were required to itemize the federal, then you. You may be able to claim itemized deductions on a separate return for certain expenses that you paid separately or jointly with your spouse. An individual may elect to claim certain itemized deductions of personal expenses in lieu of claiming a standard deduction. The standard deduction is a fixed amount tax filers can deduct from their taxable income without enumerating their expenses. The standard deduction is a specified dollar amount you can deduct each year. It accounts for otherwise deductible personal expenses such as medical expenses. The rule reduced the value of a taxpayer's itemized deductions by 3% of adjusted gross income (AGI) over a certain threshold. The 3% reduction continued until. Examples of allowable itemized deductions · Either state income tax or state and local general sales taxes paid during the tax year, but not both. · Property. On the other hand, itemizing deductions often results in less taxable income and therefore less taxes owed. You might want to itemize your deductions on a Form. An individual may claim itemized deductions on an Arizona return even if taking a standard deduction on a federal return. For the most part, an individual may.

How Buy Gold Bullion

At Bullion Exchanges, buy gold bullion and gold coins online with confidence, offering a secure and extensive range of investment-grade options. Monex offers gold bars in three convenient sizes. The smallest option, 1 oz gold bullion bars are perfect for home storage and generous gift-giving. Also. To purchase, the U.S. Mint recommends using your preferred internet search engine to find a local or national coin and precious metal dealer. GoldSilver offers the world's most popular bullion products available for home delivery or storing around the world in secure, private vaults. Gold bullion bars are offered by private mints and refineries located around the globe. There is no government backing or central bank support, but these. Buy gold bullion online at Pacific Precious Metals. Trusted Gold Dealer in SF Bay Area. % Secure. Call Us Now Buy Gold online at kmega-web.ru APMEX carries a vast selection of Gold bullion for sale for both bullion investors and numismatists. Physical gold can also be bought through a bank or, perhaps more commonly, through bullion dealers. Along with the up-front charges, when buying gold, it is. Buy Gold Bullion Bars in The United States for delivery or for secure storage, live gold prices, open a gold account today. Buy 1 oz gold bars, 1 Kilo gold. At Bullion Exchanges, buy gold bullion and gold coins online with confidence, offering a secure and extensive range of investment-grade options. Monex offers gold bars in three convenient sizes. The smallest option, 1 oz gold bullion bars are perfect for home storage and generous gift-giving. Also. To purchase, the U.S. Mint recommends using your preferred internet search engine to find a local or national coin and precious metal dealer. GoldSilver offers the world's most popular bullion products available for home delivery or storing around the world in secure, private vaults. Gold bullion bars are offered by private mints and refineries located around the globe. There is no government backing or central bank support, but these. Buy gold bullion online at Pacific Precious Metals. Trusted Gold Dealer in SF Bay Area. % Secure. Call Us Now Buy Gold online at kmega-web.ru APMEX carries a vast selection of Gold bullion for sale for both bullion investors and numismatists. Physical gold can also be bought through a bank or, perhaps more commonly, through bullion dealers. Along with the up-front charges, when buying gold, it is. Buy Gold Bullion Bars in The United States for delivery or for secure storage, live gold prices, open a gold account today. Buy 1 oz gold bars, 1 Kilo gold.

Shop gold products. Buy gold bars, gold coins and gold bullion from top refiners and world mints.

Bullion Buying Checklist · 1. The reputation and expertise of your bullion dealer is important. · gold eagle reverse 20 dollar 2. · 3. Understand the fees and. Call to learn how to buy gold bullion bars & coins with Monex. One of America's trusted, high-volume gold dealers for 50+ years. An investor can buy bars, coins, and rounds in almost any size and quantity. Buyers typically get a discount for buying in large quantities or bulk. We have a wide selection of gold bullion for sale, including gold coins and gold bars in various sizes. From 1 kg gold bullion bars to Krugerrands, we have. One common way to purchase gold bars is through licensed retailers online. Prospective buyers can browse gold bar products on reputable retail websites such as. Shop gold products. Buy gold bars, gold coins and gold bullion from top refiners and world mints. For one thing, buying gold coins is the easiest way to purchase gold. Gold coins are minted by weight and guarantee purity. As well, gold coins are much easier. Bullion Buying Checklist · 1. The reputation and expertise of your bullion dealer is important. · gold eagle reverse 20 dollar 2. · 3. Understand the fees and. Buying gold bars can be a way to add stability to an investment portfolio because of gold's steadfast value during times of economic. Buy Gold Coins & Gold Bars at the Lowest Price Guaranteed from SD Bullion and Enjoy Free Shipping On Every $+ Order. The most direct way to invest in gold is to buy bullion in the form of gold bars or coins. · Buying physical gold can be expensive, given dealer commissions. Places to Buy Gold or Silver. The two most common places where you can purchase precious metals are from an online dealer, such as JM Bullion, or a local coin. BullionVault offers a marketplace exchange in accredited, pre-vaulted, privately owned, professional market bullion. You get to deal directly with another user. Over 20 years of expertise. Sold over $2 billion in precious metals. Built and operates the Texas Bullion Depository. A+ Rating from the Better Business Bureau. Alternatives include buying from online bullion dealers, local coin shops, or precious metals exchanges, which often provide more competitive prices and a wider. Looking to buy gold, gold coins, gold bars and gold rounds online? Silver Gold Bull US has the best gold bullion selection and service. Order online today! Buy Gold and Silver Bullion Online at BGASC. FREE Shipping on $+ Orders. Immediate Delivery - Call Us Buy Gold Bullion at SilverTowne. Large selection of Gold Bullion and Coins for Sale. Your trusted Coin & Bullion Dealer Since KITCO buys & sells low price Gold Bullion Coins and Bars. Established in , KITCO is the worlds #1 Gold News website and a trusted online Gold Dealer. kmega-web.ru allows you to buy gold at the best price, 24 hours a day, 7 days a week. The buying process is fast and simple: all you have to do is create an.

What Is The Best Full Size Suv To Buy

The Genesis GV80, Porsche Cayenne, and Volvo XC90 are among the best luxury SUVs to buy today. best luxury suvs for Best New Full-Size Luxury SUVs in Get a quote, book a test drive and even buy your Nissan from home. About To find the best offers and nearby inventory, we need to find your location. The Ford Expedition or Nissan Armada are probably the best values and would suit your overall needs well. It isn't what you asked for but for 3. Top 10 best mid-size SUVs · Hyundai Tucson · Kia Sportage · Skoda Enyaq · Renault Scenic · Lexus NX · Tesla Model Y · Nissan Ariya · Mercedes GLC · Nissan. The Ford Expedition or Nissan Armada are probably the best values and would suit your overall needs well. It isn't what you asked for but for 3. What is the large SUV with the best resale value? · Toyota Land Cruiser · Toyota Sequoia · Chevrolet Tahoe · GMC Yukon · Ford Flex · Chevrolet Suburban · GMC Yukon XL. The Chevy Tahoe has sold four times as many vehicles as its closest competitor. · The Ford Expedition overtook the Tahoe as the best selling large SUV for one. 1. Lincoln Navigator, length m · 2. Toyota Tundra, length m · 3. Ford Excursion, length m · 4. Chevrolet Suburban, length m · 5. Cadillac Escalade. The Buick Enclave has always been a spacious and smooth-riding seven-passenger SUV. The all-new Enclave delivers on those fronts, too. The Genesis GV80, Porsche Cayenne, and Volvo XC90 are among the best luxury SUVs to buy today. best luxury suvs for Best New Full-Size Luxury SUVs in Get a quote, book a test drive and even buy your Nissan from home. About To find the best offers and nearby inventory, we need to find your location. The Ford Expedition or Nissan Armada are probably the best values and would suit your overall needs well. It isn't what you asked for but for 3. Top 10 best mid-size SUVs · Hyundai Tucson · Kia Sportage · Skoda Enyaq · Renault Scenic · Lexus NX · Tesla Model Y · Nissan Ariya · Mercedes GLC · Nissan. The Ford Expedition or Nissan Armada are probably the best values and would suit your overall needs well. It isn't what you asked for but for 3. What is the large SUV with the best resale value? · Toyota Land Cruiser · Toyota Sequoia · Chevrolet Tahoe · GMC Yukon · Ford Flex · Chevrolet Suburban · GMC Yukon XL. The Chevy Tahoe has sold four times as many vehicles as its closest competitor. · The Ford Expedition overtook the Tahoe as the best selling large SUV for one. 1. Lincoln Navigator, length m · 2. Toyota Tundra, length m · 3. Ford Excursion, length m · 4. Chevrolet Suburban, length m · 5. Cadillac Escalade. The Buick Enclave has always been a spacious and smooth-riding seven-passenger SUV. The all-new Enclave delivers on those fronts, too.

Choose from the Yukon & Yukon XL full-size SUVs with ample seating and impressive trailering capability. Opt for the smaller, compact Terrain SUV for a. You are sitting high with better visibility; Easy to get in and out of the SUV; A lot of space in an SUV as compared to a car. Best Full-Size SUVs · Chevrolet Tahoe · GMC Yukon · Chevrolet Suburban · Jeep Wagoneer · Ford Expedition · Nissan Armada · Toyota. The best large SUV is the Jeep Wagoneer, with an overall score of out of What is the cheapest large SUV? Currently, the Ford Expedition tops the list of kmega-web.ru's best fullsize SUVs. After hours of test driving and analysis, our experts assigned the Expedition. The Ford Expedition, Ford Expedition MAX, and Chevrolet Tahoe are the highest-rated models on kmega-web.ru's list of best fullsize SUVs. Which of the. Best Large SUV Winner: Ford Everest. A veritable Swiss Army knife of the Large SUV world, the Ford Everest is equally skilled at school drop-offs, long-distance. Some examples of full-size SUVs are the Ford Expedition and the Explorer. Full-size SUVs are usually built on a truck-like platform, which means they have a. Choose from the Yukon & Yukon XL full-size SUVs with ample seating and impressive trailering capability. Opt for the smaller, compact Terrain SUV for a. Explore the full lineup of Ford's SUVs & Crossovers. Discover pricing information, explore vehicle features, or configure & customize your own SUV. Explore the best full-size SUVs by vehicle ratings, and dive deeper with the specifics and other customizable filters. See Top Ranked SUVs · #1 Ranked SUVs. Subaru Crosstrek · Best Subcompact SUV. Subaru Crosstrek · Best Compact SUV. Nissan Rogue · Best Small Hybrid. The Sequoia is the only Toyota full-size SUV and offers the most passenger and cargo space. It offers a seating capacity up to 8 ensuring you don't have to. The BMW X5 is one of the best all-round SUVs you can buy. Sure it ticks all the practicality boxes, but it also gets a high quality interior, so even though. 6 Best Large SUVs – Full-Size SUV Comparison · Acura MDX · Cadillac Escalade · Cadillac XT6 · Ford Expedition · GMC Yukon · Lincoln. Choose the full-size Yukon SUV with ample seating and impressive trailering capability. Opt for the smaller, compact Terrain SUV for a remarkable range of. You've worked hard to get here – now enjoy going everywhere else. The BMW X7 full-size SUV features luxurious finishes, expert engineering. Large SUVs (– inches long) · Chevrolet Traverse: $34, MSRP · Chevrolet Tahoe: $54, MSRP · Dodge Durango: $40, MSRP · Ford Explorer: $36, MSRP · GMC. Shop Popular Full-Sized SUV Models ; Chevrolet Suburban · Ford Expedition EL · Jeep Wagoneer ; Chevrolet Tahoe · GMC Yukon · Nissan Armada ; Ford Expedition · GMC. A large SUV rental has room for up to seven people and offers third row of seating along with plenty of room for luggage. Full-size SUVs are great for.

Good Indian Stocks

best long term stocks · 1. Ksolves India, , , , , , , , , , , · 2. Nestle India, Discover top Indian stocks poised for long-term growth! Invest wisely for the next decade with these solid investment picks. Buy ICICI Prudential Life Insurance Company, target price Rs Motilal Oswal · Buy Amber Enterprises India, target price Rs Motilal Oswal · Buy Pricol. Most Active - India Stocks. The most active India stocks are determined by several parameters and market indicators, depicting leaders, laggards, gainers. Top Gainers - India Stocks. Explore the biggest gainers across India stocks. kmega-web.ru provides all the needed data, real time prices, historical chart. Most companies offer their stocks at very small prices where beginners can start their investment journey. Read this article to learn about some of the best. Moneycontrol do in-depth research and analyze the stock market and picks stocks which have the best momentum. , MARUTI SUZUKI INDIA LTD. ; , AXIS BANK LTD. ; , Oil and Natural Gas Corporation Ltd, ; , TATA MOTORS LTD. Market Information ; , ICICI BANK LTD. ; , INFOSYS LTD. ; , STATE BANK OF INDIA, ; , HINDUSTAN UNILEVER LTD. best long term stocks · 1. Ksolves India, , , , , , , , , , , · 2. Nestle India, Discover top Indian stocks poised for long-term growth! Invest wisely for the next decade with these solid investment picks. Buy ICICI Prudential Life Insurance Company, target price Rs Motilal Oswal · Buy Amber Enterprises India, target price Rs Motilal Oswal · Buy Pricol. Most Active - India Stocks. The most active India stocks are determined by several parameters and market indicators, depicting leaders, laggards, gainers. Top Gainers - India Stocks. Explore the biggest gainers across India stocks. kmega-web.ru provides all the needed data, real time prices, historical chart. Most companies offer their stocks at very small prices where beginners can start their investment journey. Read this article to learn about some of the best. Moneycontrol do in-depth research and analyze the stock market and picks stocks which have the best momentum. , MARUTI SUZUKI INDIA LTD. ; , AXIS BANK LTD. ; , Oil and Natural Gas Corporation Ltd, ; , TATA MOTORS LTD. Market Information ; , ICICI BANK LTD. ; , INFOSYS LTD. ; , STATE BANK OF INDIA, ; , HINDUSTAN UNILEVER LTD.

Top Companies in India by Market Capitalization ; RELIANCE IND. 2,, % ; TCS, 4,, % ; HDFC BANK, 1,, % ; BHARTI AIRTEL, 1,, %. Indian stocks with the best yearly performance ; CCCCL · +1,%, INR ; TAHMARENT · D · +1,%, INR ; LLSIND · D · +%, INR ; ESPIRE · D · +. Top Companies in India · 1. Shree Cement Ltd. 93, (Mid Cap) · 2. Maruti Suzuki India Ltd. 3,87, (Large Cap) · 3. Bajaj Auto Ltd. 3,27, (Large Cap). Learn why Indian stocks may That said, investors may be missing other key factors that could help India run its longest and best bull market ever. Top stocks ; 1. Nestle India, ; 2. P & G Hygiene, ; 3. Colgate-Palmoliv, ; 4. Lloyds Metals, Which are the top growth stocks in India right now? · #1 ZOMATO · #2 TRENT · #3 ADANI GREEN ENERGY · #4 INDUS TOWERS · #5 BAJAJ HOLDINGS & INVESTMENT. 1. OBEROI REALTY: BREAKOUT FROM CONSOLIDATION. On the daily timeframe, the stock has given a bullish breakout from a falling trendline resistance. Top Volume ; State Bank of India. ₹ (%) ; Bharat Electronics. ₹ (%) ; NTPC. ₹ (%) ; HDFC Bank. ₹1, (%). Stocks ; Angel One Ltd. 3 star. 2, ; eClerx Services Ltd. 4 star. 2, ; Gravita India Ltd. 3 star. 2, ; Hindustan Aeronautics Ltd. 5 star. 4, Bajaj Finance, HDFC Bank, Hindustan Unilever, ICICI Bank, ITC, Larsen & Toubro, NTPC, State Bank of India, Sun Pharma and Tata Consultancy. Key Takeaways · India has two primary stock markets, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). · The BSE is India's oldest stock. Stock to buy today: Indian Overseas Bank (₹): BUY bl-premium-article-image · Stock to buy today: Astral (₹2,) · Stock to buy today: Hindalco Industries (₹. Granules India Ltd., incorporated in the year , is a Mid Cap company (having a market cap of Rs Crore) operating in Pharmaceuticals sector. Fri, The top 10 stocks for are the stocks of companies that are scaling up a business or enjoying tailwinds in their respective sectors that will continue to. 4 min read. Stocks · What is CPR in Trading. 27 August 3 min read. 1. 2. 3. 4. 5. c Groww. All rights reserved, Built with ♥in India. Version - MARUTI SUZUKI INDIA LTD. Sell. OPEN. ₹ Buy rated by analysts ; Vedanta Ltd · ₹ · % ; Jindal Steel & Power Ltd · ₹ · % ; Union Bank of India · ₹ · % ; Hitachi Energy India Ltd. Tickertape provides data, information & content for Indian stocks, mutual funds, ETFs & indices. Anchorage Technologies Private Limited. Indian Top Stock Picks from Analysts - Potentially undervalued companies with a strong past performance and robust balance sheet.

What Percentage Of Charitable Donations Are Tax Deductible

Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your. An individual's charitable contributions deduction is subject to , , and percent limitations unless the individual qualifies for the unlimited. It can be up to 30 percent of your adjusted gross income. Combine multi-year deductions into one year - Many taxpayers won't qualify for the necessary. Generally, you can deduct contributions of money or property you make to, or for the use of, a qualified organization. Feldstein speculates that eliminating tax deductions would reduce giving to them by only 7 percent to 13 percent. 1 Boskin, M.J. & Feldstein, M. Effects of the. You must itemize your deductions to claim the tax deduction for charitable donations. · The amount you can deduct depends on the type of donation, up to a. Charitable contributions are generally tax deductible, though there can be limitations and exceptions. Eligible itemized charitable donations made in cash, for. Contributions of cash and ordinary income property to tax-exempt organizations (public charities) are generally limited to a maximum deduction of 50 percent of. Charitable giving not only benefits others in need, but as a taxpayer, your charitable contribution can actually count as a tax deduction. Deducting donations. Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your. An individual's charitable contributions deduction is subject to , , and percent limitations unless the individual qualifies for the unlimited. It can be up to 30 percent of your adjusted gross income. Combine multi-year deductions into one year - Many taxpayers won't qualify for the necessary. Generally, you can deduct contributions of money or property you make to, or for the use of, a qualified organization. Feldstein speculates that eliminating tax deductions would reduce giving to them by only 7 percent to 13 percent. 1 Boskin, M.J. & Feldstein, M. Effects of the. You must itemize your deductions to claim the tax deduction for charitable donations. · The amount you can deduct depends on the type of donation, up to a. Charitable contributions are generally tax deductible, though there can be limitations and exceptions. Eligible itemized charitable donations made in cash, for. Contributions of cash and ordinary income property to tax-exempt organizations (public charities) are generally limited to a maximum deduction of 50 percent of. Charitable giving not only benefits others in need, but as a taxpayer, your charitable contribution can actually count as a tax deduction. Deducting donations.

Individuals can claim up to 75% of their net income in charitable donations each year. In addition any unused tax credit can be carried forward for up to five. charitable tax benefit equals the tax credit percentage Resident taxpayers subject to the tax may deduct the amount of their charitable donations in. If you won't be itemizing your deductions on your federal tax return — and most taxpayers won't — be sure to take advantage of the special $ Charitable contributions can qualify as tax deductions against a business's annual tax liability. Generally, up to 50 percent of adjusted gross income can be. An individual may carry forward for five years any qualifying cash contributions that exceeds his or her contribution base. A qualified contribution for this. For your donation to be tax deductible the organization must have received (c)(3) status as a charitable organization from the IRS. (c)(3) organization's. General Rules · 60 percent · 50 percent · 30 percent · 20 percent. When you donate cash an IRS-qualified (c)(3) public charity, you can generally deduct up to 60% of your adjusted gross income. Donating to charity feels good. So does the tax deduction. It's not surprising that nearly 75% of high-income taxpayers donate cash to charity. from two-thirds in to just percent in Following the enactment of the Tax Cuts and Jobs Act of , approximately 90 percent of Americans. Contributions of cash and ordinary income property to tax-exempt organizations (public charities) are generally limited to a maximum deduction of 50 percent of. Medical expenses are deductible only if above a certain amount. 2. "SOI Tax Stats—Tax Stats-at-a-Glance. deduct 80% of the donation tax credit to reduce any AMT payable. Furthermore, taxpayers would have to include 30% of capital gains on donated shares to. Annual income tax deduction limits for gifts to public charities, including donor-advised funds, are 30% of adjusted gross income (AGI) for contributions of non. The limit for charitable deduction of cash donations is 60% of adjusted gross income (AGI). For appreciated assets such as stocks and property, the donation is. the tax credit for charitable donations and other gifts; · the additional tax credit for a large cultural donation; · the tax credit for cultural patronage. Charitable Deductions Limits. How much of a donation is tax deductible? The limit on the deductibility of cash charitable contributions to an eligible. Cash Donations: Generally, you can deduct up to 60% of your adjusted gross income (AGI) for cash donations to qualified charities. Non-Cash Donations: The limit. Charitable tax credits are typically worth 20% to 40% of the amount of donations you claim, and can be worth up to 50%. Their value depends on the amount of. percentage standard." How To File a Complaint. If you feel a charity Charitable donations must meet specific criteria with the IRS to be tax deductible.

How To Open Stock Portfolio

A stock market portfolio is an investors collection of stocks, funds, and other market-traded securities. In general, investment portfolios often include some. To add a stock or fund to your portfolio, you can either select on the plus sign on the stock (check the box to the left of the stock if on web) or the "Add. Steps to open an account · 1. Choose the type of investment account you want · 2. Compare fees, pricing schedules, and minimum balance requirements · 3. Review. Already have a brokerage account? You can start investing now. Simplify your portfolio management by transferring your investments from other companies to. If you already have a Cash Account, you can invest immediately when you open a Stock Investing Account. If you don't have an existing Wealthfront Cash Account. Stocks and stock funds, such as mutual funds and exchange-traded funds (ETFs), can be an important component of your portfolio. New investors may want to. If I wanted to talk about my interesting investments at parties or wanted a new hobby, I might invest % of my portfolio in individual stocks. Typically, you'll fill out an online form providing information on your employment, net worth, investable assets, investment goals, as well as your basic. Ready to get started? Open an account, explore professional advice, we offer expert help at the low cost you'd expect from Vanguard. A stock market portfolio is an investors collection of stocks, funds, and other market-traded securities. In general, investment portfolios often include some. To add a stock or fund to your portfolio, you can either select on the plus sign on the stock (check the box to the left of the stock if on web) or the "Add. Steps to open an account · 1. Choose the type of investment account you want · 2. Compare fees, pricing schedules, and minimum balance requirements · 3. Review. Already have a brokerage account? You can start investing now. Simplify your portfolio management by transferring your investments from other companies to. If you already have a Cash Account, you can invest immediately when you open a Stock Investing Account. If you don't have an existing Wealthfront Cash Account. Stocks and stock funds, such as mutual funds and exchange-traded funds (ETFs), can be an important component of your portfolio. New investors may want to. If I wanted to talk about my interesting investments at parties or wanted a new hobby, I might invest % of my portfolio in individual stocks. Typically, you'll fill out an online form providing information on your employment, net worth, investable assets, investment goals, as well as your basic. Ready to get started? Open an account, explore professional advice, we offer expert help at the low cost you'd expect from Vanguard.

This guide will help new traders understand exactly what stocks are and how to pick the right ones. Also, discover what can impact the price of a stock. Self-directed investing lets you trade securities on your own with total control. Invest with a self-directed brokerage account. Diversify Your Investment Portfolio Think about spreading your investments across different types of assets. Markets are unpredictable. The purpose of. Portfolio · Portfolio · AccountPositions · AccountPositions · Trade · Trade · Trading Investing in stock involves risks, including the loss of principal. In. 1. Choose the type of investment account you want. Identifying the right brokerage account for you will depend largely on your financial objectives. WellsTrade® gives you the flexibility to trade stocks on your own with enhanced market research and extended trading hours. Create your own portfolio with self-directed investing and hand-pick the assets you're most interested in. Low fees. Trade stocks for as little as 1¢/share 1. Stocks are one of the most common investments. Learn what stocks are, the risks associated with them, and the role they can play in an investment portfolio. High risk investments Individual stocks: When many think of investing, stocks are likely one of the first methods that come to mind. Buying a stock. Mutual funds or exchange-traded funds (ETFs) are often a great way to gain access to a wide range of asset classes. Stocks provide growth potential, but can be. Stocks are one of the most common investments. Learn what stocks are, the risks associated with them, and the role they can play in an investment portfolio. Legal name · Current address · Social Security number (or other tax ID number) · Years of previous knowledge or experience in securities such as stocks, options. The MSCI World Index is a portfolio of stocks that represent the economy in developed countries. It includes some of the world's biggest companies — like. From building an investment portfolio to managing your everyday finances, the Morgan Stanley Access Direct self-directed brokerage account gives you the. investment needs, or start with our expert's Mutual Fund Screened List. Compare your portfolio against 9 asset allocation models with our asset allocation tool. investments, trade stocks, ETFs, and more. Open an account today Invest in publicly traded companies and start customizing your investment portfolio today. Ready to start your investing journey? The Investor's Edge online investing platform and mobile stock Step 1: Open an account. It's secure. Fast. And easy. While the concept of stock markets may trigger images of young brokers yelling "Buy! If you don't review your portfolio regularly, you could end up with a. It takes just minutes to open your account online. If you need help, give us a call 24/7 at Find the account that may be right for you. Step. 1. Determine your asset allocation. See our sample asset allocation plans above. · Step. 2. Diversify within asset classes. Stocks and bonds can be broken.

Best Place To Sell Foreign Currency

Using the ATM network of your bank is the most cost-effective option to exchange money abroad. To increase your chances of avoiding unwanted costs, find out. Top 10 Best Foreign Currency Exchange Near Los Angeles, California · 1. Currency Exchange Hollywood - LAcurrency · 2. Currency Exchange Glendale - LAcurrency · 3. Customers with Bank of America checking and savings accounts can order foreign currency through Online Banking or the Mobile Banking App. TransferWise is an online currency exchange service that allows people to exchange currency using mid-market rates. The company was founded in March and. Florida Currency Exchange is the place to go for low exchange rates in Sarasota! Florida Currency Exchange buys & sells foreign money from pesos to dinar. At A&D Coin, we understand the value of collecting and preserving world and foreign paper money. That's why we are a trusted place for those looking to sell old. Order 55+ foreign currencies online or in person at any TD Bank location and pick up within 2–3 business days · Exchange foreign currency for U.S. dollars when. View our list of foreign currency exchange locations. Rockland Trust can help you with immediate exchange at your local branch. Visit today! Order 55+ foreign currencies online or in person at any TD Bank location and pick up within 2–3 business days1; Exchange foreign currency for U.S. dollars when. Using the ATM network of your bank is the most cost-effective option to exchange money abroad. To increase your chances of avoiding unwanted costs, find out. Top 10 Best Foreign Currency Exchange Near Los Angeles, California · 1. Currency Exchange Hollywood - LAcurrency · 2. Currency Exchange Glendale - LAcurrency · 3. Customers with Bank of America checking and savings accounts can order foreign currency through Online Banking or the Mobile Banking App. TransferWise is an online currency exchange service that allows people to exchange currency using mid-market rates. The company was founded in March and. Florida Currency Exchange is the place to go for low exchange rates in Sarasota! Florida Currency Exchange buys & sells foreign money from pesos to dinar. At A&D Coin, we understand the value of collecting and preserving world and foreign paper money. That's why we are a trusted place for those looking to sell old. Order 55+ foreign currencies online or in person at any TD Bank location and pick up within 2–3 business days · Exchange foreign currency for U.S. dollars when. View our list of foreign currency exchange locations. Rockland Trust can help you with immediate exchange at your local branch. Visit today! Order 55+ foreign currencies online or in person at any TD Bank location and pick up within 2–3 business days1; Exchange foreign currency for U.S. dollars when.

There's a convenient place to buy or sell currency from dozens of countries: your local Zions Bank branch office. With easy ordering and competitive exchange. If you've come back from your holiday with some spare cash, take it to a Post Office branch that deals in foreign currency and we'll buy it back from you. Central Bank is here to offer an easier way to travel the globe with our Foreign Currency Exchange services. We have great exchange rates that allow. Currency Exchange International specializes in foreign currency exchange. They buy and sell more than 80 foreign currencies and hold currency in stock daily. Wells Fargo account holders can order foreign currency cash online, or at a branch, and have delivery within business days. Travelers will avoid having to ask strangers in a foreign country where to exchange currency or where to find an ATM. Pricing. For more information on other. OANDA's Currency Converter allows you to check the latest foreign exchange average bid/ask rates and convert all major world currencies. To exchange or sell your foreign currency visit a U.S. Bank branch and we'll help you through the process. We encourage you to make an appointment to allow. If you're looking for a certified foreign currency dealer where you can buy foreign currency, sell foreign currency, or have foreign currency appraised, contact. INTRUST offers services to the international traveler that are not available just anywhere, including foreign currency exchange and wire transfers. Our. In my experience, the exchange rates are generally good and it's the most convenient way to get foreign currency if you can plan ahead. From ordering foreign currency cash to sending international wire transfers, Wells Fargo's foreign exchange can help you prepare for your next international. Our Best Rate Guarantee ensures you receive a competitive foreign currency exchange rate every day. CXI will match or beat any local bank or airport for the. Sell your old foreign currency and get new money! Sell it all online with Now is a great time to have a clear out and turn your money into money. Foreign Currency Exchange: See Commerce Bank branch locations that carry select foreign currency. Any location can order currency as needed. I've been having a hard time finding a place to exchange them for dollars that isn't way off the mid-market exchange rate, which as of today is Shekels. We offer more than 50 currencies available for purchase, competitive exchange rates, and convenient pickup locations. Competitive exchange rates and rates for selling back unused currency; Better rates for larger dollar amounts; Currency arrives within two days of your order. GREAT BRITAIN, POUND (GBP) 1 GBP = USD. HONG KONG, DOLLAR (HKD) 1 HKD Find a branch location near you to order foreign currency cash for. Payset offers currency exchange services that empower businesses to sell foreign currency online and obtain the best rates for your leftover currency.

Medical Billing Coding Certification Cost

How much does a Medical Billing and Coding Certificate program cost? Here at DeVry, the total cost of your education depends on several factors such as. To become a Certified Medical Coder, you need to take an online training course that teaches you the CPT®, ICDCM, and HCPCS Level II code sets. Most. The Professional Certificate in Medical Coding fee is $2, and the program can be completed within 6 months. Enroll Now. Course Fee $2, National. The Medical Billing and Coding Certificate program provides training for entry-level employment in a medical practice setting. The cost of obtaining your certificate is about $3, (conservative estimate). What Courses Do You Take? Coursework in each of the above-mentioned programs. Program Information · Total Cost: $3, (includes textbooks, AAPC membership fee, & AAPC exam voucher) · January 27, - June 25, Mondays and Wednesdays. Certification Exam-$ Total Program Cost $5, C. Provide a list of all books required for the program (even if cost of books is included in tuition). Tuition/Fees/Financial Assistance. The Medical Billing and Coding Program cost is $2, (including all electronic program materials). This program is. The Length of this course is about 11 months, with an estimated total cost of $5, Medical Coder & Biller Fee Sheet. How much does a Medical Billing and Coding Certificate program cost? Here at DeVry, the total cost of your education depends on several factors such as. To become a Certified Medical Coder, you need to take an online training course that teaches you the CPT®, ICDCM, and HCPCS Level II code sets. Most. The Professional Certificate in Medical Coding fee is $2, and the program can be completed within 6 months. Enroll Now. Course Fee $2, National. The Medical Billing and Coding Certificate program provides training for entry-level employment in a medical practice setting. The cost of obtaining your certificate is about $3, (conservative estimate). What Courses Do You Take? Coursework in each of the above-mentioned programs. Program Information · Total Cost: $3, (includes textbooks, AAPC membership fee, & AAPC exam voucher) · January 27, - June 25, Mondays and Wednesdays. Certification Exam-$ Total Program Cost $5, C. Provide a list of all books required for the program (even if cost of books is included in tuition). Tuition/Fees/Financial Assistance. The Medical Billing and Coding Program cost is $2, (including all electronic program materials). This program is. The Length of this course is about 11 months, with an estimated total cost of $5, Medical Coder & Biller Fee Sheet.

You can take AAPC's online course for around $$ That also includes the cost of the certification exam. Upvote Downvote Reply reply. Estimated Adult Tuition and Fees; $ Estimated Materials Cost; $ Cost Information; Course Costs · Material Costs. Estimated High School Student. Our Medical Billing and Coding training offers flexible and affordable payment options which include the cost of your (CBCS) certification exam. Medical billing and medical coding pros are vital in today's technology-driven health care system. Our online certificate program can prepare you for this. What you need to know about getting your Medical Billing and Coding Certificate (CIP ) ; Tuition, $3,, $9, ; Additional Costs, $2,, $2, Program Fee Overview ; $ · $ · $ · $ ; $ · $ · $ · N/A. Penn Foster also provides students in the program with a voucher covering the cost of their CBCS exam (a $ value) as well as a complete exam prep study. The certified coding specialist (CCS) costs $ for AHIMA nonmembers and $ for members. Candidates need two years of work experience, or CCA certification. $ ($ if registered 10 days or more before start of the course) – includes course materials and instruction. $ (Online course). REGISTER. Completion of other coding training program to include anatomy & physiology, medical terminology, basic ICD diagnostic/procedural and basic CPT® coding. Apply. How much do online medical coding classes cost? AAPC packages range from $ to $, giving students the best education at the best value compared to. UCM certificate cost icon, $4, including books, fees and examination. Additional fees: Laptop (if needed), $ ; Contact hours icon, (including out of. This course is $2, with an additional $ exam cost. A 25% down payment is required for registration. Adult Education and Literacy offer funding. Entry-level positions typically require completion of a certificate and passing one of the certification exams or an associate degree program in medical billing. Medical Billing Undergraduate Certificate Program Tuition and Fees ; Per Credit Hour, Per 3-Credit Course, Approximate Tuition Cost ; $ Lower Division. Q. How much does a Medical Coding and Billing Course cost? A. Depending on the program the cost can vary. USCI is proud to offer an affordable. Certificates · Offered by universities or colleges · Earned based on achieving good grades in required courses rather than passing an exam · Awarded by higher. Duration: 80 hours · Dates: October 07, – January 22, · Days: Mondays and Wednesdays · Times: pm – pm · Location: Huntsville Campus · Cost. Costs range from $$ AHIMA requires individuals to earn 20 continuing education units every two years to maintain their certification. Certification. Certified Professional Coder (CPC) certification exam costs $ What Are The Best Schools That Offer Medical Billing and Coding Programs? Professionals that.

1 2 3 4 5