kmega-web.ru

Overview

Junior Accountant Executive Job Description

Junior Account Executive Job Description · Manage preparation of all market materials for international markets · Assist in Trade Shows (Coterie, Intermezzo) and. The Junior Accountant reviews the organizational financial guidelines and procedures to ensure the business is following the proper state and federal. Junior accountants maintain the financial records of companies through the analysis of their general ledger accounts and balance sheets. The accountant's post. A junior accountant is an entry-level position in the field of accounting responsible for assisting senior accountants and financial professionals in various. Junior Accountant responsibilities are: Keep accounts receivable٫ accounts payable and issue invoices up to date; Perform reconciliation operations; Manage. He/She covers duties such as work that is specific to accounts receivable, accounts payable, tax filing, data compilation, billing, payroll or other accounting. Junior Accountant is a professional who provides support to the financial department by managing daily accounting tasks. Your duties and responsibilities would include maintaining general ledger accounts and the company's fixed assets. To sum up, you will help the company to make. As a junior accountant, you will be responsible for maintaining, preparing, and reconciling accounts and other financial documents. Junior Account Executive Job Description · Manage preparation of all market materials for international markets · Assist in Trade Shows (Coterie, Intermezzo) and. The Junior Accountant reviews the organizational financial guidelines and procedures to ensure the business is following the proper state and federal. Junior accountants maintain the financial records of companies through the analysis of their general ledger accounts and balance sheets. The accountant's post. A junior accountant is an entry-level position in the field of accounting responsible for assisting senior accountants and financial professionals in various. Junior Accountant responsibilities are: Keep accounts receivable٫ accounts payable and issue invoices up to date; Perform reconciliation operations; Manage. He/She covers duties such as work that is specific to accounts receivable, accounts payable, tax filing, data compilation, billing, payroll or other accounting. Junior Accountant is a professional who provides support to the financial department by managing daily accounting tasks. Your duties and responsibilities would include maintaining general ledger accounts and the company's fixed assets. To sum up, you will help the company to make. As a junior accountant, you will be responsible for maintaining, preparing, and reconciling accounts and other financial documents.

We are looking for an ambitious Junior Accountant to provide support to the financial department by managing daily accounting tasks. Job Description · Manage all aspects of Accounts Receivable, Accounts Payable and general ledger · Prepare, examine and analyze accounting records, financial. Reconcile bank accounts, credit card transactions, suppliers', and customers' balances. Entry requirements. Bachelor's Degree in Accounting. years of proven. The title refers to the duties of the employee. In this arrangement, junior accountants do more of the day-to-day data entry and book balancing. Senior. As a junior accountant, you will be responsible for maintaining financial records, calculating taxes, and ensuring compliance with accounting standards. Assists senior accountants with all financial operations. · Compiles weekly and monthly financial statements and reports. · Prepares and analyzes balance sheets. The Junior Accountant is responsible for working with the accounting team to provide support in the execution of established Company accounting practices and. Job Summary: The Junior Accounting Clerk will perform routine clerical, filing, and data entry tasks for accounting data including accounts payable, billing. Job description · Process accounts payables, enter incoming payments, and verify bank deposits · Code invoices, set up new accounts, reconcile accounts, and. Position: Accounts Assistant / Junior Accountant. Duties and responsibilities: ▫ Tally data entry including sales, purchase, receipts, payments, bank. As a Junior Accountant you will perform accounts receivable and accounts payable functions. Under the supervision of a Senior Accountant you will assist in the. Secure a promotion within one year by assuming journal entry and basic reconciliations responsibilities in addition to already performing AP functions. The Junior Accounts Executive will be responsible for handling on accounts payable and receivable and preparing for banking transactions. 1d ago. Apply To Junior Accounts Executive Jobs On kmega-web.ru, #1 Job Portal In India. Explore Junior Accounts Executive Job Openings In Your Desired. The role of an account executive (AE) is to build relationships with new clients and manage relationships with existing ones. Account executive jobs exist. Junior Accounting Clerk Responsibilities · Assist in the preparation of financial statements and reports. · Process accounts payable and accounts receivable. Entry-Level Accountant Job Description Sample · Work under the direction of senior accountants · Accurately perform data entry tasks · Analyze data sets for. Accounts Payable Specialist · Staff Accountant · Jr. Accountant · Junior Accountant · Accountant (Entry-level) · Accounts Payable Assistant · Junior Accountant · Staff. Their duties include preparing financial reports, maintaining accounts payable and receivable, and updating financial statements. The duties and. Junior Accountant roles encompass a variety of job titles, each with specific responsibilities and areas of focus. From handling basic accounting tasks to.

Cheapest Car Insurance For Young Men

Progressive, Geico, Auto-Owners, State Farm and Nationwide tend to offer low average premiums and robust coverage options for young drivers. If you're a young. The best way to get cheap car insurance is to compare quotes from several inexpensive insurers, as you will be able to select the lowest price for the coverage. InsuranceHero finds the best young driver's insurance offer from Canada's leading insurance companies. Visit us today or call us at IIHS and Consumer Reports (CR) have joined forces to make it easier for young drivers or their parents to find a vehicle that checks all those boxes. Teen and. Safe young drivers save up to 20% when they buy online. start my quote · Retrieve my quote Make a claim Renew my policy. GO! Car insurance for young drivers. This may seem unfair because there are good drivers in every age group, but younger drivers are generally more likely to have accidents or take risks on the. Aviva Auto Canada: Aviva Canada offers competitive rates for drivers with a clean driving record, and provides discounts for bundling insurance policies. Geico's premiums for teen drivers are among the most cheap out of the 17 companies surveyed by WalletHub. However, Geico earned the highest WalletHub editor. What Is The Cheapest Car Insurance For Male Drivers Between 20 and 25 Years Old? · GEICO - $ · Progressive - $1, · State Farm - $1, · Allstate - $1, Progressive, Geico, Auto-Owners, State Farm and Nationwide tend to offer low average premiums and robust coverage options for young drivers. If you're a young. The best way to get cheap car insurance is to compare quotes from several inexpensive insurers, as you will be able to select the lowest price for the coverage. InsuranceHero finds the best young driver's insurance offer from Canada's leading insurance companies. Visit us today or call us at IIHS and Consumer Reports (CR) have joined forces to make it easier for young drivers or their parents to find a vehicle that checks all those boxes. Teen and. Safe young drivers save up to 20% when they buy online. start my quote · Retrieve my quote Make a claim Renew my policy. GO! Car insurance for young drivers. This may seem unfair because there are good drivers in every age group, but younger drivers are generally more likely to have accidents or take risks on the. Aviva Auto Canada: Aviva Canada offers competitive rates for drivers with a clean driving record, and provides discounts for bundling insurance policies. Geico's premiums for teen drivers are among the most cheap out of the 17 companies surveyed by WalletHub. However, Geico earned the highest WalletHub editor. What Is The Cheapest Car Insurance For Male Drivers Between 20 and 25 Years Old? · GEICO - $ · Progressive - $1, · State Farm - $1, · Allstate - $1,

Geico's premiums for teen drivers are among the most cheap out of the 17 companies surveyed by WalletHub. However, Geico earned the highest WalletHub editor. Often, the way to get the cheapest car insurance for drivers under 25 is to add the new driver to an existing policy of a parent or guardian. This will likely. Drivers with more experience on the road often pay much lower auto insurance premiums than newer and younger drivers. Type of Vehicle: The year, make, and. Discounts applied consecutively, new business customers only. Best Price available online. Win a car | Young Drivers Car Insurance | An Post Insurance. Auto-Owners, Travelers and Geico offer some of the cheapest insurance for young adults. Young drivers may be able to save on their premiums by shopping around. How much is car insurance? Get quote. Man researching car insurance prices on computer teen driver to their policy to lower the cost of insuring new drivers. Hanover is the most expensive insurer for young adults, with a full coverage policy priced at $4, per year, on average. Generally, drivers in their 20s are. Contact a GEICO agent when your teen gets their permit or driver's license to get a quote for a new driver on your policy. Moving a Teen or Young Driver to. USAA offers discounts on car insurance for young drivers. Members can get a policy at a great rate, and receive the coverage they need. State Farm used to be the cheapest for me, then Geico, now Progressive with no changes in vehicles or driving record, credit score etc. You just. At Liberty Mutual, we make it easy for teens and young drivers under 25 to get affordable car insurance. With several auto insurance discounts available to. Learn why car insurance rates for teens are higher and how to find affordable insurers, so young adults generally pay more for car insurance than older adults. Are you looking for cheap auto insurance but worried about sacrificing quality and service in favor of a more affordable rate? GEICO has you covered. The word ". Learn why car insurance rates for teens are higher and how to find affordable insurers, so young adults generally pay more for car insurance than older adults. The cheapest car insurance companies for first-time drivers are Travelers, USAA, and Geico, according to WalletHub's analysis. Let us save you money by helping you find the best, cheap car insurance quotes. Enter your zip code to get cheap insurance quotes. Car insurance is more expensive for under 25s, but there are a few ways for young drivers to keep their premium down. Here's how to get cheaper car. Male, $ Disclaimer: Table data sourced from real-time Looking for the cheapest auto insurance as a driver younger than 21 can be a bit overwhelming. Progressive has the best rates by far IMO. We switched from Geico when we bought a new car last year, the rates were going to go down a little.

Most Profitable Solar Companies

Solar as an Economic Engine As of , more than , Americans work in solar at more than 10, companies in every U.S. state. In , the solar. Biggest companies in the Solar Panel Installation in the UK ; EvoEnergy Ltd. ; Solar Century Holdings Ltd. ; kmega-web.ru Energy ECO Installations Ltd. N/A. High Growth Companies ; FSLR First Solar, Inc. , +%, +% ; NXT Nextracker Inc. , +%, %. FREEDOM SOLAR SHATTERS PRE-PANDEMIC RECORDS WITH. ITS MOST PROFITABLE Q2 TO DATE. The Austin-Based Solar Company Saw 55% Year Over Year Growth and Record. Is the Solar Market Profitable Today? Learn more and get the insights on the current state of the solar market. In , First Solar became the first solar panel manufacturing company to lower its manufacturing cost to $1 per watt. As of , First Solar was considered. Combined with the lowering costs of installation, under the right circumstances, most modern solar panels systems can “pay for themselves” in under 10 years. Overall, we recommend SunPower or ADT Solar for most Ohio solar customers. These companies service the entire state and provide access to high-quality panels. Performance Comparison ; SEDG. SolarEdge Technologies. ; ENPH. Enphase Energy. ; RUN. Sunrun. ; FSLR. First Solar. ; DQ. Daqo New Energy. Solar as an Economic Engine As of , more than , Americans work in solar at more than 10, companies in every U.S. state. In , the solar. Biggest companies in the Solar Panel Installation in the UK ; EvoEnergy Ltd. ; Solar Century Holdings Ltd. ; kmega-web.ru Energy ECO Installations Ltd. N/A. High Growth Companies ; FSLR First Solar, Inc. , +%, +% ; NXT Nextracker Inc. , +%, %. FREEDOM SOLAR SHATTERS PRE-PANDEMIC RECORDS WITH. ITS MOST PROFITABLE Q2 TO DATE. The Austin-Based Solar Company Saw 55% Year Over Year Growth and Record. Is the Solar Market Profitable Today? Learn more and get the insights on the current state of the solar market. In , First Solar became the first solar panel manufacturing company to lower its manufacturing cost to $1 per watt. As of , First Solar was considered. Combined with the lowering costs of installation, under the right circumstances, most modern solar panels systems can “pay for themselves” in under 10 years. Overall, we recommend SunPower or ADT Solar for most Ohio solar customers. These companies service the entire state and provide access to high-quality panels. Performance Comparison ; SEDG. SolarEdge Technologies. ; ENPH. Enphase Energy. ; RUN. Sunrun. ; FSLR. First Solar. ; DQ. Daqo New Energy.

New York State is making solar energy more accessible to homes, businesses, and communities. Through NY-Sun, New York's initiative to advance the scale-up. panels may not be the most ideal option. The size, shape, and slope of your roof are also important factors to consider. Typically, solar panels perform best. An honest and dependable company for your Solar project, with only your interest in mind. What differentiates this company from other solar companies is their. The top company on the list is JinkoSolar, located in Shanghai, with revenue of $ billion. It is the world's largest solar panel manufacturer. So when we come back to short term, market sometimes temporary looks bear because of fierce competition among solar companies which led to very. So I decided to setup a ground mounted solar power plant in my land which is in a very sunny area. I plan to sell the generated electricity to. Solar farms should stay profitable for 30+ years. Ours actually do. Learn We uncover potential roadblocks and give you the most accurate forecasts – not the. Jinko Solar was voted best overall solar panel brand with an Elite rating from SolarReviews'. In 4th place is Jinko Solar, one of the biggest solar. The fund has an expense ratio of %, which put it among the most expensive ETFs in clean energy sector. At the same time, it is among the largest clean energy. In most areas, utilities will exchange kilowatt-hours (kWh) one to one when their customer produces electricity through the use of solar panels. However. The largest solar company by market capitalization is First Solar (FSLR), valued at $ billion as of Q1 What Is Elon Musk's Solar Company Called? Elon. Bankruptcy risk and low profitability could slow the pace of clean energy transitions if companies are unwilling to invest because of low returns or are. most profitable and recession-proof companies in the country. 07 — Generate Carbon Offset. Franchisees will install enough solar every year to offset the. Since , Sun Light & Power has been providing homeowners, businesses and non-profits with exceptional solar solutions. companies that are committed to. Boston Solar is the leading commercial solar company in New England. We've been in business for over a decade and have installed more than 5, solar energy. Who are the developers of these solar projects? Most solar projects in Wisconsin are developed by private companies that have developed renewable energy. Project Solar cuts out the sales person and saves you thousands. Whether you opt for DIY or full service, we hold your hand through the whole process. Small Solar Made Affordable Experience savings of up to 1/3 below conventional cost on small-energy-footprint homes and nonprofit organizations. Various elements of the solar energy market directly impact the profits of solar companies. One of the most typical incentives is tax credits or rebates that. Geenex is a leading national developer of greenfield utility-scale solar projects in the U.S. Our team of experts carefully educate and guide our clients.

How Many Cd Accounts Can I Have

:max_bytes(150000):strip_icc()/cd-basics-how-cds-work-315245-v4-5ba5068946e0fb002558ccde.png)

How much can you earn? · More for your money. CDs offer our most competitive, promotional rates - and great returns. · Guaranteed returns. Choose the term length. The welcoming lobby interior of an Amerant Banking Center. Opening a Certificate of Deposit Account. Here's how you can set up your CD. 1. Building a CD ladder Overall interest rates may change during your CD's term. However, if rates go down, you benefit: You still earn the higher rate that was. Your earning potential with a CD depends on the rate, term and deposit amount. Unlike traditional savings accounts, you can't keep adding more funds to your CD. can consider money market accounts, which are certain types of FDIC-insured savings accounts that have restrictions such as limits on how funds can be withdrawn. So you can open CDs at several banks and have them each covered up to $, by the FDIC. But if you have a savings account, checking account and CD at. There are many misconceptions about Certificate Though CD accounts have been around for quite a while, consumers may have some misconceptions about them. How Much You Need to Retire · Planning Calculators · Complimentary Plan · Advice Broad selection: You can hold brokered CDs in different investment account. By signing up for a certificate of deposit (CD) or share certificate, you can earn extra cash without extra risk. As long as your financial institution is. How much can you earn? · More for your money. CDs offer our most competitive, promotional rates - and great returns. · Guaranteed returns. Choose the term length. The welcoming lobby interior of an Amerant Banking Center. Opening a Certificate of Deposit Account. Here's how you can set up your CD. 1. Building a CD ladder Overall interest rates may change during your CD's term. However, if rates go down, you benefit: You still earn the higher rate that was. Your earning potential with a CD depends on the rate, term and deposit amount. Unlike traditional savings accounts, you can't keep adding more funds to your CD. can consider money market accounts, which are certain types of FDIC-insured savings accounts that have restrictions such as limits on how funds can be withdrawn. So you can open CDs at several banks and have them each covered up to $, by the FDIC. But if you have a savings account, checking account and CD at. There are many misconceptions about Certificate Though CD accounts have been around for quite a while, consumers may have some misconceptions about them. How Much You Need to Retire · Planning Calculators · Complimentary Plan · Advice Broad selection: You can hold brokered CDs in different investment account. By signing up for a certificate of deposit (CD) or share certificate, you can earn extra cash without extra risk. As long as your financial institution is.

Refer a friend and you both could earn a Cash Bonus on Online Savings Accounts. account opening, you'll get the higher rate!) No-Penalty CD: Your rate. See how much you could earn compared to leaving funds in your savings account. Can I get interest disbursements from my CD? Yes. Interest disbursements can. CDs are great for extra funds you have on hand that you don't expect to tap during the investment period. CDs can be rolled over at term's end. Higher Yields Guaranteed returns · Our Highest CD Rate · See how much your money could grow with Quontic · Frequently asked questions · Banking should be easy. Or you can transfer money from an eligible Capital One checking or savings account to fund your CD. It's that simple! Now that you have the basics, here are the. Find out how much you could earn with a BMO Alto Online CD. How much money do You have 10 days from account opening to fund your CD. Early. There are many misconceptions about Certificate Though CD accounts have been around for quite a while, consumers may have some misconceptions about them. Find the CD rate that fits your savings goal. Calculate how much interest you can earn and apply for a certificate of deposit (CD) account online. CD Calculator: See How Much You Could Earn. Use our free CD calculator A CD account will have a specific term length, like 12 months. Oftentimes. get that higher rate. Savings help is available over the phone 24 hours a day / 7 days a week. How much will my Marcus High-Yield CD account earn? The money. How can we help? How was your experience? Give us feedback. 1. Special Interest Rate CDs require a $5, minimum opening deposit unless otherwise noted. Like HYSAs, most CDs are FDIC-insured up to $, per account. Many CD providers have a minimum amount required to open the account, usually around $ How Much You Need to Retire · Planning Calculators · Complimentary Plan · Advice Broad selection: You can hold brokered CDs in different investment account. You don't have to do anything to get these rates when you let your CD automatically renew. A penalty will be imposed for early withdrawals on CDs. At. A brokered CD is similar to a bank CD in many ways. Both pay a set Since changes in interest rates will have the most impact on CDs with longer. While CDs can serve many savings goals, they may not be the best for all situations. CDs are a fit over other financial options when you: Don't need frequent or. Savings & Interest-Bearing Accounts · Solicitations · Statements and Records Will I have to pay a fee or penalty if I need to withdraw funds from my. CDs are great for extra funds you have on hand that you don't expect to tap during the investment period. CDs can be rolled over at term's end. Certificate of Deposit (CD) · Earn % Annual Percentage Yield · Choose the term and deposit amount that are right for you. · How to get a certificate of deposit. The welcoming lobby interior of an Amerant Banking Center. Opening a Certificate of Deposit Account. Here's how you can set up your CD. 1.

Top Ten Cd Rates

Top banks offering 1-year CD rates for August · Bread Savings · CIBC Bank USA · First Internet Bank of Indiana · TAB Bank · Limelight Bank · Bask Bank · Marcus by. TOP THE TREASURY %APY 2-YEAR TREASURY INDEXED CD ; 90 Day CD. % APY* ; 6 Month CD. % APY* ; 9 Month CD. % APY* ; 12 Month CD. % APY* ; 18 Month. Summary of best CD rates ; LendingClub · % ; NASA Federal Credit Union · % ; Bread Savings · % ; First Internet Bank · % ; Sallie Mae Bank · %. What is a Certificate of Deposit (CD)? · Are CDs worth it? · Are CDs a good investment? · Are CDs safe? · What are the CD rates? · What's the difference between APY. There's no minimum deposit required to open your account, and you'll always get the best rate we offer for your CD term with the Ally Ten Day Best Rate. Have a short-term savings goal you want to achieve within a year? Western Alliance Bank offers some of the highest rates for 1 year and under CDs that we can. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from DR Bank for a 6-month term. That APY is nearly three times. Summary of the highest CD rates ; Sallie Mae certificates of deposit · %, % ; My eBanc Online Time Deposit · %, % ; Bread Savings certificates of. Best year CD rates The highest year CD rate today is % from First National Bank of America. Top banks offering 1-year CD rates for August · Bread Savings · CIBC Bank USA · First Internet Bank of Indiana · TAB Bank · Limelight Bank · Bask Bank · Marcus by. TOP THE TREASURY %APY 2-YEAR TREASURY INDEXED CD ; 90 Day CD. % APY* ; 6 Month CD. % APY* ; 9 Month CD. % APY* ; 12 Month CD. % APY* ; 18 Month. Summary of best CD rates ; LendingClub · % ; NASA Federal Credit Union · % ; Bread Savings · % ; First Internet Bank · % ; Sallie Mae Bank · %. What is a Certificate of Deposit (CD)? · Are CDs worth it? · Are CDs a good investment? · Are CDs safe? · What are the CD rates? · What's the difference between APY. There's no minimum deposit required to open your account, and you'll always get the best rate we offer for your CD term with the Ally Ten Day Best Rate. Have a short-term savings goal you want to achieve within a year? Western Alliance Bank offers some of the highest rates for 1 year and under CDs that we can. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from DR Bank for a 6-month term. That APY is nearly three times. Summary of the highest CD rates ; Sallie Mae certificates of deposit · %, % ; My eBanc Online Time Deposit · %, % ; Bread Savings certificates of. Best year CD rates The highest year CD rate today is % from First National Bank of America.

% APY, or annual percentage yield, is the yearly return on a bank or investment account. APY includes the effects of compounding interest. For the 1-year category, we include CD maturities from ten to 14 months. Banks and credit unions sometimes offer their highest rates on CD Specials with non-. CD Rates Earn our best rate no matter the term – whether short or long. Start growing your savings today and secure your financial future with us! With a. Current Rates ; 18 Month CD Special, $10, Additional% increase with $10, New Money to Passumpsic Bank = % APY*, %, % ; 3-Month CD, $ Alliant Credit Union offers CD terms ranging from three to 60 months, earning up to % APY. There's a $1, minimum deposit required for all CDs. Alliant. Get % APY on a 7-Month CD! Watch your savings grow when you earn interest on your money with a Dollar Bank Certificate of Deposit (CD). Start with a great rate, plus have the opportunity to increase your rate once over the 2-year term or twice over the 4-year term if our rate for your term. Bankrate's picks for the top 5-year CD rates · SchoolsFirst Federal Credit Union · First Internet Bank of Indiana · America First Credit Union · Synchrony Bank. We offer a variety of terms and great fixed rates so saving is simple and secure. Open an SCCU CD for as little as $ More for your money. CDs offer our most competitive, promotional rates - and great returns. · Guaranteed returns. Choose the term length that works best for you. The highest CD rate we've found for August is from Newtek Bank, which currently pays out a % variable annual percentage yield (APY) on 2-year CDs. The highest certificates of deposit (CDs) rates today are offered by Merchants Bank of Indiana (%), First Federal of Lakewood (%), Maries County Bank . The best 1-year CD rate right now is % APY from three institutions. If you're looking to save money for a short-term goal, a 1-year CD may be the right. Rate and Annual Percentage Yield (APY) in effect on the maturity date unless you make a change on the maturity date or during the ten-calendar-day grace period. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. USALLIANCE Financial currently has the highest rate on 2-year CDs. You might like this CD if you're interested in joining a credit union. You can join. First Internet Bank of Indiana pays a great interest rate on several CDs, including a 1-year term. This bank is also offers one of the best money market account. Take advantage of the opportunity to earn a higher interest rate by investing in a short-term CD. Minimum needed to open a CD with GRB is just $ Prime Alliance Bank offers a great 1-year business CD, with a % APY. The $ minimum deposit requirement is not great, but its interest rate is the highest. 1-year CD rates · Bread Savings — % APY · CIBC Bank USA — % APY · America First Credit Union — % APY.

How To Get Interest From Savings Account

Our savings calculator makes it easy to find out. Using the three sliders at the bottom of the calculator, select your initial deposit, how much you plan to. Make your money work for you when you open a TD High Interest Savings Account. Sign up for higher interest rates and watch your savings grow with TD. Compare savings accounts to find the best rates. Bankrate's experts have identified the highest savings account interest rates from top banks to help you. Learn how opening a Higher Interest Savings Account with a Huntington checking account can help you earn even more interest on this high interest/yield. The formula for calculating interest on a savings account is: Balance x Rate x Number of years = Simple interest. What's Compound Interest Compared With Simple. How to make a budget for the new year · To qualify for the annual matching deposit Reward, you must: 1) make 11 consecutive monthly deposits, per myRewards. You can calculate the simple interest rate by taking the initial deposit or principal, multiplying by the annual rate of interest and multiplying it by time. To increase the income from your Savings Account, consider the following tips: Look for trusted banks to open a Savings Account. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access. Our savings calculator makes it easy to find out. Using the three sliders at the bottom of the calculator, select your initial deposit, how much you plan to. Make your money work for you when you open a TD High Interest Savings Account. Sign up for higher interest rates and watch your savings grow with TD. Compare savings accounts to find the best rates. Bankrate's experts have identified the highest savings account interest rates from top banks to help you. Learn how opening a Higher Interest Savings Account with a Huntington checking account can help you earn even more interest on this high interest/yield. The formula for calculating interest on a savings account is: Balance x Rate x Number of years = Simple interest. What's Compound Interest Compared With Simple. How to make a budget for the new year · To qualify for the annual matching deposit Reward, you must: 1) make 11 consecutive monthly deposits, per myRewards. You can calculate the simple interest rate by taking the initial deposit or principal, multiplying by the annual rate of interest and multiplying it by time. To increase the income from your Savings Account, consider the following tips: Look for trusted banks to open a Savings Account. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access.

With a high-yield savings account, you can get a solid interest rate and your money grows even faster thanks to compound interest — which lets you earn interest. Our picks at a glance ; Laurel Road High Yield Savings. %. $ ; Bask Bank Interest Savings. %. $ ; BrioDirect High-Yield Savings. %. $ Savings Account interest = Daily account balance x Savings Account interest rate x No. of days/ (Days in a year). If you maintain ₹50, for 30 days, the. Wondering how to save money while earning interest? Open a PayPal Savings account to earn interest on savings, manage your savings, and more. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. The formula for calculating simple interest is A = P x R x T. A is the amount of interest you'll wind. Find the right account for your savings goals ; Savings accounts. Bonus opportunities on select products · Build a nest egg or emergency fund; Earn interest. A savings account is an account at a bank or credit union that is designed to hold your money. Savings accounts typically pay a modest interest rate. It's never too early to begin saving. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Checking. Get Overdraft Protection for your Truist personal checking account with no overdraft transfer fees. Earn interest. Feel more financially confident by. It's easy. Simply divide your APY by 12 (for each month of the year) to find the percent interest your account earns per month. To earn interest on a savings account, you must first open one with a bank or other financial organisation. You can put money into your account. Generally, checking accounts don't earn interest. However, they do offer other important banking benefits. Ideas to Earn More Interest on Savings Account · 1. Maintain High Monthly Average Balance · 2. Choose from a Wide-Range of Savings Accounts · 3. Link Your FDs. APY is used to determine the amount of interest you can earn for a savings account over one year. Unlike annual percentage rate (APR), which reflects the simple. When you set up Savings, you're agreeing to have future Daily Cash automatically deposited into your account — this allows you to earn interest on the Daily. Earn interest · No minimum balance with EZ Save automatic savings plan · Requires an Old National Checking Account · Enjoy convenience of online and mobile banking. A CIT Bank savings account helps you get more from your savings with interest rates for maximum growth. Our savings products have different features and rates. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. How much of a difference does this make? If you deposit $50, into a traditional savings account with a %, you'll earn just $ in total interest after.

Allsurplus Auction Reviews

Allsurplus Or Liquidity Services Auctioneers reviews, customer feedback & support. Contact & review Allsurplus Or Liquidity Services Auctioneers. Welcome to kmega-web.ru! Should you have any questions, contact us by email or at () Practice bidding below on the TEST AUCTION FOR BIDDERS. AllSurplus, Bethesda, Maryland. likes · talking about this. AllSurplus is the world's leading marketplace for business surplus. GovDeals auction site can be accessed by anyone with a subscription. People OA Periodic Rule Review. all surplus City Review page. Vehicles. The City of Seattle surpluses used fleet vehicles and equipment through contracted auction services. Only a few days are left before our Standard Bank online auction closes! Register today at kmega-web.ru or WhatsApp "Standard. This organization is not BBB accredited. Online Auctions in Hebron, KY. See BBB rating, reviews, complaints, & more. GovDeals' online marketplace provides services to government, educational, and related entities for the sale of surplus assets to the public. Auction rules. AllSurplus Deals is an online auction featuring retail returns, overstock and unsold inventory from today's top online and big box retailers! Allsurplus Or Liquidity Services Auctioneers reviews, customer feedback & support. Contact & review Allsurplus Or Liquidity Services Auctioneers. Welcome to kmega-web.ru! Should you have any questions, contact us by email or at () Practice bidding below on the TEST AUCTION FOR BIDDERS. AllSurplus, Bethesda, Maryland. likes · talking about this. AllSurplus is the world's leading marketplace for business surplus. GovDeals auction site can be accessed by anyone with a subscription. People OA Periodic Rule Review. all surplus City Review page. Vehicles. The City of Seattle surpluses used fleet vehicles and equipment through contracted auction services. Only a few days are left before our Standard Bank online auction closes! Register today at kmega-web.ru or WhatsApp "Standard. This organization is not BBB accredited. Online Auctions in Hebron, KY. See BBB rating, reviews, complaints, & more. GovDeals' online marketplace provides services to government, educational, and related entities for the sale of surplus assets to the public. Auction rules. AllSurplus Deals is an online auction featuring retail returns, overstock and unsold inventory from today's top online and big box retailers!

Waco Independent School District has contracted Clark Auction Company, LLC to host an online auction of ALL Surplus items Reviews. Connect with us. We. We are an auto auction, on auction day your duties will OSHA reviewsBP Florence reviewsBerkley reviewsCarter Lumber reviewsCity of Mason reviews. Get more information for Manheims Greater Phoenix Auto Auction in Tolleson, AZ. See reviews, map, get the address, and find directions AllSurplus Deals is an. notify PSB of all surplus supplies. Section , ARM, indicates auction items to GSA for review/approval. We noted in the two most recent. Jump into the excitement and score up to 90% off retail prices! Become a master at snagging the best deals in our online auctions, where every bid brings you. I must say that the shipping complaint is all due to my lack of due diligence. That being said, the actual auction itself left me a bit. Auction Service, LLC, also provi More Info & Listings. AllSurplus. AllSurplus. Bethesda, MD 0 Reviews · More Info & Listings. W. Wachter Auctions &. Wisconsin Surplus is a family-owned business with a long history in the auction industry based in Mount Horeb, Wisconsin. We enjoy a respected name and. Administrative Rules Review. Utility Menu All surplus items are sold "as-is, where-is". Do I have to be a dealer to attend auctions or bid online? all surplus property. With delegation, the agencies should use the B public auction, consignment auction, online auction or sealed bid. Live. AllSurplus buyers have direct access to the best surplus equipment deals AllSurplus with our competitive online auctions and instant “Buy Now” options. Government auctions & retail sales of all all surplus supplies, materials and equipment owned by North Carolina state agencies and universities. The Surplus department collects, stores, and offers for sale to the public all surplus University property. Property sold through an online auction site will. All your site settings from GoIndustry DoveBid have been integrated onto AllSurplus. Your Current Activity. Auctions, listings, recorded assets and watchlists. PublicSurplus has a rating of stars from 86 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers complaining. AllSurplus Bidder Registration View Auction Listings Close. ×. GovDeals Ryan M. Customer, Yelp Review. As a long time customer of the Sierra Auction. All surplus vehicles, carts, and boats are sold by Fleet Services via online auction. Assets will be listed for a minimum of 14 days with the highest bidder. VIEW PUBLIC AUCTION Buy surplus property from the State of Arizona by bidding on items on sale by the Surplus Property Management Office (SPMO). The Scam Detector website Validator gives kmega-web.ru a medium trust score on the platform: It signals that the business can best be defined by the. Only a few days are left before our Standard Bank online auction closes! Register today at kmega-web.ru or WhatsApp "Standard.

What Do You Include In Debt To Income Ratio

Your DTI ratio helps creditors determine whether you can afford new debt. It plays a major role in your creditworthiness as lenders want to make sure you're. Add up all of your monthly debt payments (which don't include utilities, groceries, phone and cable bills, insurance costs, etc.). · Divide your total debts by. Debt-to-income (DTI) ratio is the percentage of your monthly gross income that is used to pay your monthly debt and determines your borrowing risk. Then, they divide the total by your monthly gross income to determine your DTI ratio. Here is an example of how a lender might calculate your debt-to-income . Step 2: Add all your monthly debts together. Step 3: Write down all your monthly income, including wages, tips, business income, Social Security and other. As explained by the Consumer Financial Protection Bureau, your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This. Debt-to-income ratio is calculated by dividing your monthly debts, including mortgage payment, by your monthly gross income. Most mortgage programs require. You can calculate your DTI manually — just add up your total monthly debt payments, and then divide that amount by your gross monthly income (the total monthly. How do you lower your debt-to-income ratio? Make a plan for paying off your credit cards. Increase the amount you pay monthly toward your debts. Extra. Your DTI ratio helps creditors determine whether you can afford new debt. It plays a major role in your creditworthiness as lenders want to make sure you're. Add up all of your monthly debt payments (which don't include utilities, groceries, phone and cable bills, insurance costs, etc.). · Divide your total debts by. Debt-to-income (DTI) ratio is the percentage of your monthly gross income that is used to pay your monthly debt and determines your borrowing risk. Then, they divide the total by your monthly gross income to determine your DTI ratio. Here is an example of how a lender might calculate your debt-to-income . Step 2: Add all your monthly debts together. Step 3: Write down all your monthly income, including wages, tips, business income, Social Security and other. As explained by the Consumer Financial Protection Bureau, your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This. Debt-to-income ratio is calculated by dividing your monthly debts, including mortgage payment, by your monthly gross income. Most mortgage programs require. You can calculate your DTI manually — just add up your total monthly debt payments, and then divide that amount by your gross monthly income (the total monthly. How do you lower your debt-to-income ratio? Make a plan for paying off your credit cards. Increase the amount you pay monthly toward your debts. Extra.

Your debt-to-income ratio reflects how much of your income is taken up by debt payments. Understanding your debt-to-income ratio can help you pay down debt and. And unless you are keeping the home you currently own, don't include your current mortgage. 2) Add your projected mortgage payment to your debt total from step. Start by determining your gross monthly income, which is your income before taxes and deductions. You can either divide your annual income by 12, multiply your. When you borrow, lenders scrutinize two aspects of your DTI – the front-end ratio and the back-end ratio. The front-end ratio includes your housing expenses and. Debt-to-income ratio = your monthly debt payments divided by your gross monthly income. Here's an example: You pay $1, a month for your rent or mortgage. DTI is expressed as a percentage, which is calculated by dividing your total recurring monthly debt by your monthly gross income. Monthly debt should include. If you're a homeowner, you can also calculate your mortgage debt-to-income ratio. The Bureau recommends that you do not include names, account numbers, or. If your DTI ratio is 30%, for example, that means that 30% of your monthly gross income is used to pay your monthly debt. How Is the Debt-to-Income Ratio. As explained by the Consumer Financial Protection Bureau, your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This. Monthly Debt Payments That Are Included in the DTI Formula: · Credit cards · Mortgage (including homeowner's insurance, property taxes and HOA dues) · Car loans. You can determine your debt-to-credit ratio by dividing the total amount of credit available to you, across all your revolving accounts, by the total amount of. What is included in a debt-to-income ratio? Your DTI ratio compares your monthly bill payments to your gross monthly income. · How can you calculate my debt-to-. Add your total expected housing expenses. This includes the principle and interest mortgage payment, taxes, insurance and any HOA dues. · Divide your housing. Debt-to-income ratio (DTI) is the ratio of total debt payments divided by gross income (before tax) expressed as a percentage, usually on either a monthly or. Total monthly debts are $3, To calculate your back-end DTI, you divide your monthly debts by your gross monthly income and multiply it by $3, ÷. The back-end DTI ratio does not factor in bills such as cell phone bill, cable and internet, health insurance premiums, car insurance premiums, utility bills. Total debt payments = $ · Gross monthly income = $3, · Debt-to-Income Ratio= $ / $3, = 22%. This includes cumulative debt payments, so think credit card payments, car payments, student loans, personal loans and any other debt you may have taken on. The final step to calculate your debt to income, is to divide your total monthly debt payments by your monthly gross income. To get a percentage, move the.

Health Care Stocks With Dividends

The Health Care Select Sector Index includes companies from the All results are historical and assume the reinvestment of dividends and capital gains. Companies in this sector primarily include health care equipment and supplies, health care providers and services, biotechnology, and pharmaceuticals. HCA Healthcare Data and the Affordable Care Act · Press Kit · Contact Us · Annual S&P Nasdaq Dow Other. Reinvest Dividends. Calculate Investment. Targeted access to domestic healthcare stocks. 3. Use to express a sector dividends and capital gains. Fund expenses, including management fees and. Our research team runs the industry's toughest health care dividend screening test and only picks from the top 5%. Invests primarily in healthcare stocks, across pharmaceutical, biotechnology, healthcare services, and medical technology companies; Leverages proprietary. Which Healthcare stocks pay dividends? Pfizer does not currently pay dividends. Novartis does not currently pay dividends. Johnson & Johnson does not currently. Healthcare Stocks ; Health Information Services · Medical Distribution · Biotechnology · Drug Manufacturers - Specialty & Generic. The S&P ® Health Care comprises those companies included in the S&P that are classified as members of the GICS® health care sector. The Health Care Select Sector Index includes companies from the All results are historical and assume the reinvestment of dividends and capital gains. Companies in this sector primarily include health care equipment and supplies, health care providers and services, biotechnology, and pharmaceuticals. HCA Healthcare Data and the Affordable Care Act · Press Kit · Contact Us · Annual S&P Nasdaq Dow Other. Reinvest Dividends. Calculate Investment. Targeted access to domestic healthcare stocks. 3. Use to express a sector dividends and capital gains. Fund expenses, including management fees and. Our research team runs the industry's toughest health care dividend screening test and only picks from the top 5%. Invests primarily in healthcare stocks, across pharmaceutical, biotechnology, healthcare services, and medical technology companies; Leverages proprietary. Which Healthcare stocks pay dividends? Pfizer does not currently pay dividends. Novartis does not currently pay dividends. Johnson & Johnson does not currently. Healthcare Stocks ; Health Information Services · Medical Distribution · Biotechnology · Drug Manufacturers - Specialty & Generic. The S&P ® Health Care comprises those companies included in the S&P that are classified as members of the GICS® health care sector.

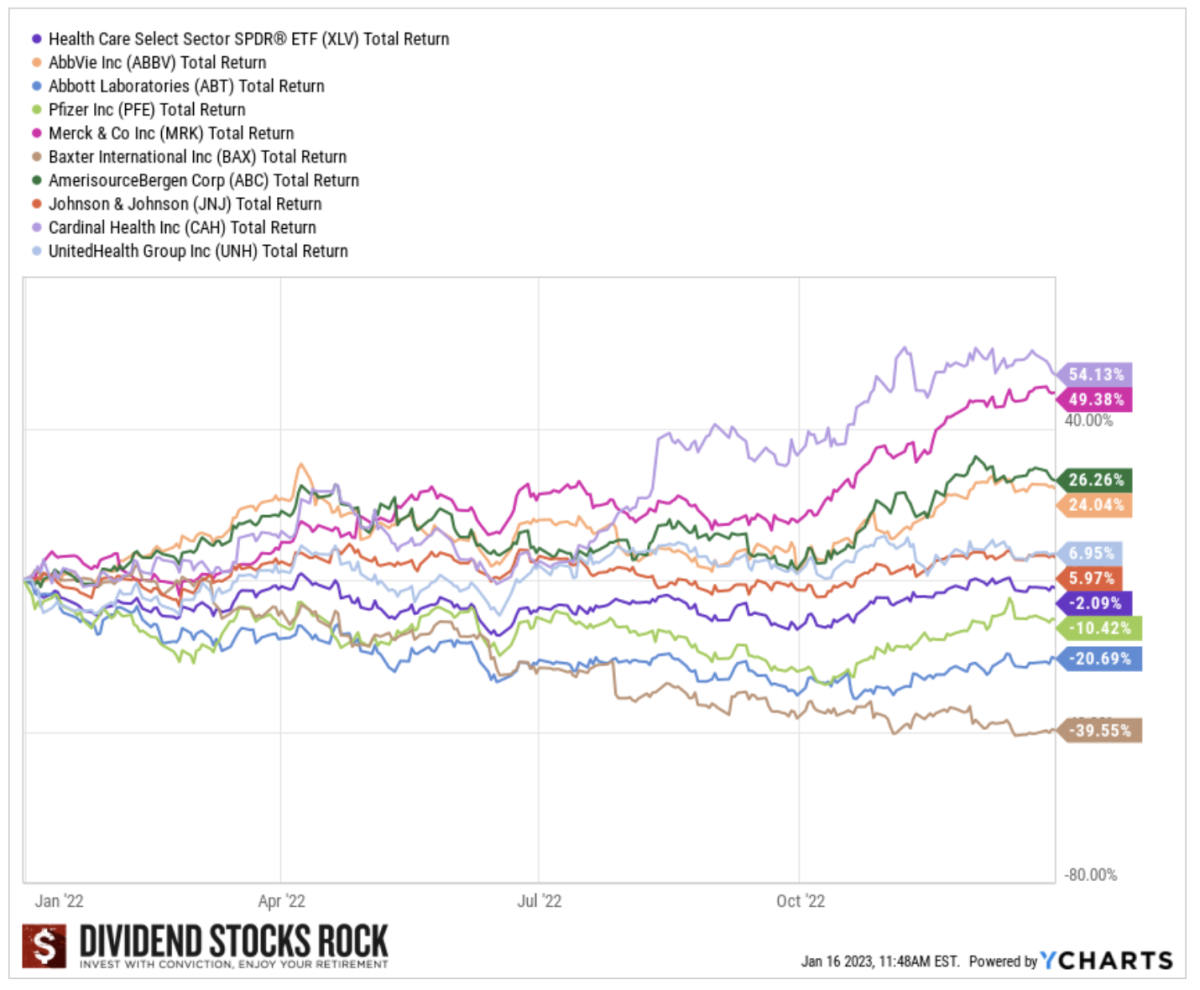

The Health Care Select Sector Index includes companies from the All results are historical and assume the reinvestment of dividends and capital gains. We are a health care and well-being company made up of a diverse team around Dividends & stock · Archive. Investor information. Shareholder resources. Best health care stocks · UnitedHealth (UNH) · GSK (GSK) · Sanofi SA (SNY) · Bristol-Myers Squibb (BMY) · Roche Holding AG (RHHBY). Growth stocks are less likely to pay dividends. Growth companies have the capacity to alter the market for their goods through innovation. The S&P Health Care comprises those companies included in the S&P that are classified as members of the GICS health care sector. Which Healthcare stocks pay dividends? Pfizer does not currently pay dividends. Novartis does not currently pay dividends. Johnson & Johnson does not currently. Healthcare sector stocks are those investments that investors make in companies and businesses which operate in the healthcare industry. The strongest healthcare sector stocks based on dividend growth (and performance of course). ABBV seems like a leader in this regard. Are there others? 8 Dividend Growth Stocks for Falling Interest Rates. Jacob Sonenshine. August 27, am ET. Lower bond yields on safe government bonds make the risk of. Includes stocks of companies involved in providing medical or health care products, services, technology, or equipment. Fund management. Vanguard Equity Index. Some of the best health care stocks for August , based on day returns, include Q32 Bio, Longboard Pharmaceuticals, and uniQure. All of the top stocks in. We are a health care and well-being company made up of a diverse team around Dividends & stock · Archive. Investor information. Shareholder resources. Discover Canadian Healthcare High Yield Dividend Stocks that are on the TSX. Healthcare Dividend Stocks can contribute substantially to shareholder returns. Top Rated Healthcare Stocks ; JNJ · JOHNSON & JOHNSON, $, $,, ; ABBV · ABBVIE INC, $, $,, Managed Health Care Stocks · Oscar Health Inc - Ordinary Shares - Class A OSCR. Price: $ Daily change: $ · Cigna Group (The) CI. Price: $ Daily. Full Health Care Dividend stocks list ; Astellas Pharmaceuti. %, Japan ; Merck & Co. %, USA ; Royalty Pharma. %, USA ; Shenzhen Hepalink Ph. %. dividend growth stocks database for health care companies with a yield at or above 2% and have increased their dividends for at least 10 consecutive years. The. Cooper Companies (NASDAQ:COO) has an annual dividend yield of N/A, which is N/A percentage points lower than the healthcare sector average of 2%. Cooper. The health care sector could have a strong setup, given recent low valuations combined with new products and long-term trends that may continue to play out. Compare Australian healthcare stocks. See a comparison of key indicators, including healthcare stock price targets and analyst recommendations.

Questions To Ask Your Wealth Manager

Here are 20 vital questions to ask when considering a financial advisory firm or assessing your current one. It can be tough to know where to start when looking for a financial advisor. Here are the key questions to ask a potential advisor. Here are the 18 essential questions to ask a wealth manager before you work with them, the answers you want to hear, and why. Here are seven essential questions you should ask a financial advisor. Whether you're starting to work with an advisor, or still searching for the right person. Questions to ask a financial advisor · 1. How will we work together? · 2. How will you communicate with me, and how often? · 3. What services do you provide? Does Your Wealth Manager Measure Up? One of the first steps to choosing the right manager for your wealth is knowing the right questions to ask. What are the financial goals of the business? This is an important question as it will help the wealth manager understand what services they. 20 Questions Every Advisor Should Ask During Prospect and Client Meetings · What have you done to manage your finances so far? · Investments go up and down, what. General questions · Tell me a little about yourself. · What interests you about working at our firm? · What do you know about our firm? · Describe three financial. Here are 20 vital questions to ask when considering a financial advisory firm or assessing your current one. It can be tough to know where to start when looking for a financial advisor. Here are the key questions to ask a potential advisor. Here are the 18 essential questions to ask a wealth manager before you work with them, the answers you want to hear, and why. Here are seven essential questions you should ask a financial advisor. Whether you're starting to work with an advisor, or still searching for the right person. Questions to ask a financial advisor · 1. How will we work together? · 2. How will you communicate with me, and how often? · 3. What services do you provide? Does Your Wealth Manager Measure Up? One of the first steps to choosing the right manager for your wealth is knowing the right questions to ask. What are the financial goals of the business? This is an important question as it will help the wealth manager understand what services they. 20 Questions Every Advisor Should Ask During Prospect and Client Meetings · What have you done to manage your finances so far? · Investments go up and down, what. General questions · Tell me a little about yourself. · What interests you about working at our firm? · What do you know about our firm? · Describe three financial.

7 questions every advisor should be able to answer. Whatever your priorities, this can help you find someone who understands you and has the resources to help. Step 1: Judge Credibility · 1. Please describe the history, size, ownership, and management of your firm. · 2. Is your firm registered with a securities. To find the right financial advisor for you, it's important to interview multiple financial advisors and ask the right questions, especially if it's your first. We have put together a list of questions to ask financial advisors. These questions will improve your conversations with any advisor you meet and might even. Below are the top 10 questions we would encourage you to ask any potential financial advisor, financial planner, or wealth manager before you hire them. The Top 9 Questions to Ask During Your First Meeting with a Wealth Management Firm · What is your investment philosophy? · What asset allocation and investment. We've outlined the key questions for you below, but it will also be important for you to make sure that you get a good sense from the financial advisor you are. Below are issues you will want to explore before you hire someone to be your financial advisor. You can ask these questions at your first meeting or send them. Ideal response: There should be none whatsoever. A wealth advisor is only truly on your side if the only compensation he or she receives as your advisor is the. How old are you? · What's your educational and certification background? · How long have you been a financial advisor? · Do you accept fiduciary responsibility? This article identifies key criteria to consider when choosing an advisory firm and advisor, as well as questions to ask potential advisors. What's the difference between nominal yields and real yields? What does this mean for treasuries? What are some of your favorite books? What's the relationship. Your wealth advisor is trusted with the financial well-being of you and your family. How do you evaluate a wealth advisor to establish trust? QUESTIONS TO ASK A POTENTIAL WEALTH MANAGER. Why is your firm special? What is your wealth management philosophy? What type of investments do you make in. It's important to work with a financial advisor who shares a planning and investing philosophy similar to your own. Does your planner stick to a scientific. If you have a high net worth make sure the person is familiar with handling clients like you. Make sure they refer to their service as wealth management or. Before you hire a financial advisor, ask them about their investment philosophy—do they prefer value or growth investing? Passive or active management? Do they. Questions can be as simple as budgeting or asking for (k) plan recommendations or health savings accounts. Whenever you have a financial concern or question. In this blog post, you will learn the key questions to ask a financial advisor so you can get the most out of your relationship and ensure you're getting the. In this Hedley & Coblog, we aim to explore the 5 questions to ask your potential Wealth Manager before hiring them.

2 3 4 5 6 7